Despite the strengthening of the resilience of the Greek economy and the banks, it recommends that there should be no complacency

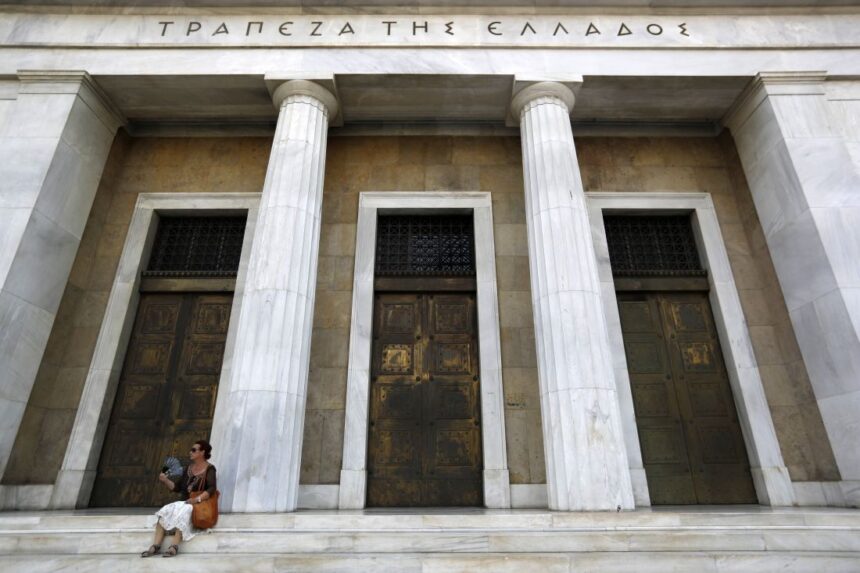

The Bank of Greece is seeing outgoing risks to financial stability, however, however, considering that the prospects for the domestic banking system remain favorable, in line with the positive performance of the Greek economy.

The financial stability report released today is noted that “the risks to financial stability in Greece are mainly exogenous, coming from the increase in geopolitical tensions and the rise of commercial protectionism”. At the same time, he estimates that the Greek economy will be indirectly affected by the possible slowdown in the growth rate of the global and European economy and the burden of the investment climate.

As far as banks are concerned, the Bank of Greece estimates that boosting the resilience of the Greek banking sector is unquestionable. In 2024, Greek banks recorded profits after taxes and interrupted activities of € 4.4 billion, compared to € 3.8 billion in 2023. In this development, the increase in net income and supplies, as well as a decrease in forecasts for credit risk, was positive.

The capital adequacy indicators of the Greek banking groups were further strengthened, mainly through the internal creation of capital and the issuance of capital media. Specifically, the Common Equity Tier 1 Ratio – Cet1 Ratio) on a consolidated basis increased to 15.9% in December 2024 and the total capital ratio (Total Capital Ratio – TCR) to 19.7% and more to the same level with the average of the bank (CET1: 15.9%: TCR: 20.0% in December 2024).

The quality of the loan portfolio of credit institutions in 2024 improved significantly, mainly due to non -organic actions. In particular, the ratio of non -performing loans to all loans declined significantly to 3.8% in December 2024 (from 6.7% in December 2023). This is the lowest level of Greece’s accession to the euro area, which has largely converged with the average in the banking union (December 2024: 2.3%).

However, as it is noted, the apparent slowdown in the euro area, as well as a possible abrupt price of assets in international money and capital markets, could have negative consequences. “Therefore, there is no room for complacency and the combinatorial application of micro -policing and macrovascular policy becomes necessary to ensure financial stability,” the report concludes.