With an increase in sales and operating profits, the nine months of January – September closed for the group Fourlis, with growth now coming mainly from IKEA sales, which is linked to both increased construction activity and increased tourism. The sportswear sector on the other hand has been affected by both the divestment in Turkey, the sale of “The Athlete’s Foot” (TAF), inflation, the lower sales rate in Romania, but also the erratic weather conditions.

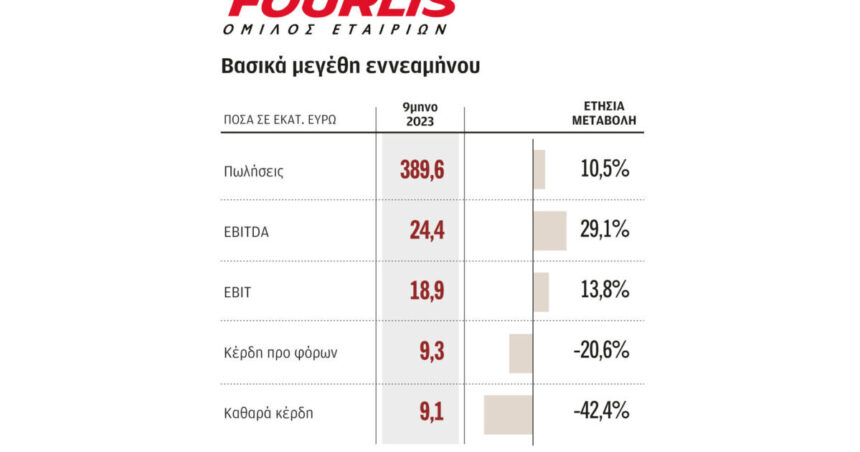

According to the results announced yesterday by the group, its sales amounted to 389.6 million euros, increased by 10.5% compared to the first nine months of 2022. On a comparable basis, excluding the sales of Intersport Turkey and her TAF, sales increased by 15% compared to the nine months of 2022. Operating earnings before interest, taxes, depreciation and amortization (EBITDA) amounted to 31.5 million euros, registering an increase of 29.1%. Operating profits before taxes and interest increased by 13.8% and amounted to 21.5 million euros.

The clean ones profitshowever, fell by 42.4%, to 5.2 million euros from 9.1 million euros in the first nine months of 2022. Excluding gains from revaluation of investment properties, net profits stood at 3.9 million euros from 4 .1 million euros in the nine months of 2022, down 3.2% due to higher minority rights compared to last year following the sale by the group on September 11, 2023 of 4.2% of its shares Trade Estates (s.b. this is the AEEAP of the group that was listed on the Stock Exchange a few days ago) in Latsco Hellenic Holdings.

Total borrowing in the nine months of ’23 decreased by 19.5 million euros and amounted to 262.5 million euros from 282 million euros in the previous nine months, mainly due to a reduction in the lending of the group’s commercial activities. This is in line with the group’s strategy to optimize its capital structure and strengthen its financial position for future growth initiatives. The group’s capital expenditures amounted to 30.1 million euros in the nine months, of which 20.7 million euros are attributed to the investments of Trade Estates AEEAP.

The retail sale of household appliances and furniture (IKEA) recorded a significant increase in sales by 17.5% year-on-year, reaching 260.1 million euros, a development largely attributed to the normalization of the supply chain. IKEA sales in Greece increased by 15.3%, while in international markets by 20.7%.

Sales of the sporting goods retail sector (Intersport) amounted to 129.3 million euros against 131.5 million euros in the nine months of 2022, recording a decrease of 1.7%. Excluding the sales of Intersport Turkey and TAF, sales increased by 8.8% compared to the nine months of 2022. Interestingly, according to the group, the gross profit margin in the sports retail business was negatively affected by the irregular weather conditions that led to greater promotions. It is noted that the gross profit margin stood at 45.2% from 47.4% last year.