At a time when other European countries are abolishing the “golden visa” or directing interested parties to other investments besides real estate, because they contributed to the artificial rise in prices, in Greece the government will proceed, as everything shows, in another facelift, increasing the minimum threshold investment. The previous time this was done (for the center of Athens and the northern and southern suburbs) there was a large increase in demand from “golden visa” applicants and property prices in other areas, such as Piraeus.

The threshold for the granting of a “golden visa” is increased

of Prokopi Hatzinikolaou

In the increase of the low limit of 250,000 euros for the acquisition “golden visa” the government is moving forward in the near future, with the aim of limiting demand on the one hand and “deflating” sales and rental prices on the other real estate. The government is reportedly considering various scenarios, but they seem to have settled on increasing the minimum amount of €250,000 to higher levels. It is indicative that recently increased real estate sales were recorded in areas such as Piraeuswhere the threshold for granting a residence permit through the “golden visa” program was maintained at 250,000 euros, as well as the Rhodesthe Chalcidice and the Crete. It is noted that the limit was doubled to 500,000 euros in center of Athensat North and southern suburbs and in specific islands of Cyclades.

Restrictive measures

As stated by the Minister of National Economy and Finance K. Hatzidakis at the POMIDA conference on the “golden visa”: “There will be measures to limit it, the thresholds will be increased to make more substantial investments, but there will be an exception for preserved properties, for which a lower minimum threshold will apply to direct funds in a real estate category that particularly needs them”.

Anyway Portugal seems to be ending the “golden visa” program, at least for real estate investments, as huge increases in real estate prices as well as rents are also recorded. Portugal’s program had capital inflows of €7.3 billion. The new program that was recently introduced offers the possibility of a license, but only through investment in investment funds. The minimum amount was kept at 500,000 euros.

On the other hand, Hungary amended the investment immigration program, which added real estate (previously excluded) to the category of investments that secure a residence permit. Specifically, those interested can obtain a license either through a minimum investment of 250,000 in real estate investment capital, or through a direct investment of a minimum amount of 500,000 euros to acquire a property.

In areas where the limit of 250,000 euros did not increase, such as Piraeus, Halkidiki and Crete, there was an increase in demand and prices.

According to foreign analysts of the investment immigration sector, such as the British Astons, the Greek program remains one of the most attractive pan-European, due to the fact that it has the lowest limit for foreign investors, i.e. 250,000 euros. Although the properties located in the most attractive parts of Attica are now excluded from this level, such as e.g. in central Athens, the northern and southern suburbs (where the minimum threshold has now doubled to €500,000), however there are still significant areas where foreign investors are already heading.

License increase

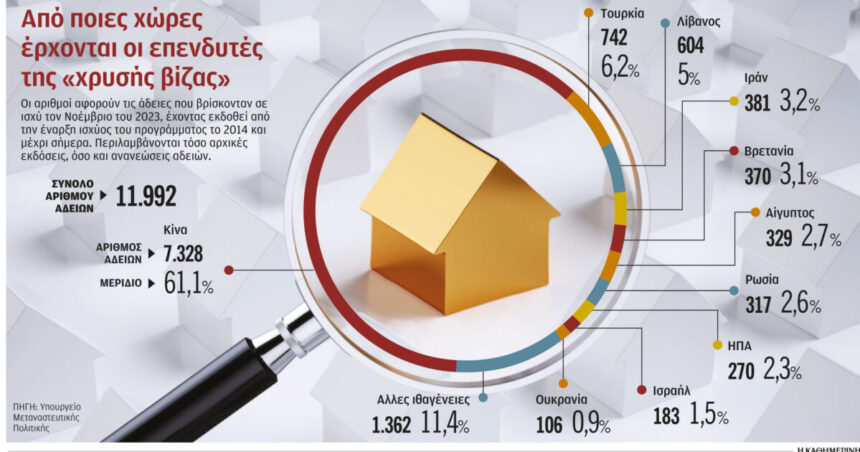

Based on his evidence Ministry of Migration Policyduring the period January – November 2023 the licenses granted to investors by Great Britain marked an increase of 77.8% to 370 (from 208), while those to Israelis increased by 77.6% to 183 (from 103).

At the moment, the approval of the granting of 7,319 licenses is pending based on the relevant requests that have been submitted to the respective services. British investors are combining the holiday home market residence by securing a residence permit. For Chinese people main priority is the acquisition of a secondary residence for their holidays and at a later stage they are considering the investment exploitation of this property, while the Israelis are looking for investment opportunities in the Greek market.

In total, however, the number of licenses that have been issued since mid-2014 to date amounts to 11,992 licenses.

According to lawyers active in the field of investment immigration, they are now being observed delays varying between 8 and 10 months until the relevant licenses are issued, although the relevant institutional framework stipulates that each license should be granted within two months of the submission of the relevant request. The changes made to the program in 2023 (increasing the minimum investment threshold in selected areas), which came into effect on August 1, caused a “frenzy” of buyers to secure properties in their preferred areas and with the low limit of 250,000 euros.

In the meantime, Mr. Hatzidakis also referred to the POMIDA proposal that provides for a three-year tax exemption for closed properties that will be put on the market. Specifically, the property owners’ proposal provides for exemption from income tax for properties that were closed in 2023, as well as for those that switch from short-term to long-term leases. The minister said: “We will study the proposal of POMIDA in relation to the houses that remain empty / out of lease. It is something we have discussed in the ministry. It is a proposition that cannot be easily dismissed. I have given instructions to the competent departments of the ministry to carry out the relevant studies, so that we can see the real number of properties based on ELSTAT data and based on these data, we can do a cost-benefit analysis. In order to be sure of the check and cross-checks we will do both for the actual number of empty apartments and for all the other parameters. So that the decision we will make is based on more data.”

The great expectations of the owners and the turn to holiday homes

by Nikos X. Rousanoglou

More than obvious is the “imprint” of the “golden visa” program on the housing market in recent years due to the great investment interest. Executives of the real estate market point out that the main reason why this is happening, besides of course the country’s economic recovery, is the fact that the Greek program is the cheapest in Europe, especially among the Mediterranean countries, which also show the greatest demand among investors.

At the same time, the increase of rents but also the appeal of short-term leases have created the conditions for many properties to now have an investment character, an element that most investors seek. On the other hand, however, no one can dispute the fact that in any areas where there is an increase in demand from abroad, there is also the phenomenon of a sharp increase in the asking prices for sale (often also for rent) by many owners who consider that the property them suitable for investment.

This fact creates distortions in the market and today, when the demand from the Greeks has also returned, it acts as an “embankment” in finding housing for many due to the excessive expectations that have been cultivated in a portion of owners. As a market executive recently explained, “in Piraeus, for example, as soon as the implementation of the changes to the “golden visa” began, from August 1, 2023 onwards, prices shot up by 30%-40%, causing them to multiply the apartments with an initial asking price of 250,000 euros”.

At the same time, another criticism that is often pointed out is that many of the houses that are bought with the aim of securing a residence permit remain empty and unused or are resold after some years, without even renewing the residence permit. Executives active in the field of investment immigration note on this issue that the cases where resales have been made for the purpose of profit are limited in number and were observed mainly in the period 2019-2020, when some foreign investors who had placed themselves in the Greek market through crisis, in the period 2015-2017, buying very cheaply, they preferred to redeem their profits.

The Greek residence permit program through the purchase of a property is the cheapest in Europe, especially among the Mediterranean countries.

This was compounded by the health crisis, as travel was prohibited for a long period of time, making travel particularly difficult, especially for non-EU citizens. Today the conditions are different and the majority of buyers from abroad are looking for properties to exploit and not to keep closed or to resell after a few years.

Meanwhile, recently more and more foreign real estate investors through the “golden visa” program have started to turn to the holiday home market as well. The lower investment “threshold” of 250,000 euros – compared, for example, to the acquisition of a residence in the center of Athens or the southern suburbs, where the limit has now been increased to 500,000 euros – is the main lure. At the same time, however, an important reason is the return that the individual investor can have from the exploitation of his holiday home during the summer months, but also the fact that he now also has a residence for his holidays.

This trend has begun to be felt in the holiday home market, according to Elxis, a company which specializes in selling holiday homes to foreign buyers, particularly from the Western and Northern European markets. As he explains in “K” Mr. George Gavrielidis, managing director of Elxis, “the shift of more investors to the holiday home market is due to the changes made to the “golden visa” program. After the increase of the limits, especially in Attica, but also in Mykonos and Santorini, we see that those who wanted to obtain a residence permit through the program have started to turn to destinations outside the big urban centers”. According to Mr. Gavrielidis, big winners are places with country properties located near or around the urban centers, in destinations such as Rhodes, Crete and Halkidiki.

Main exponents of this demand are people from the USA, Great Britain, Canada and Israel. Already, based on data from the Department of Immigration and Asylum, permits to US citizens, including several second- and third-generation expatriates, have increased by 47.5% in the period from the beginning of 2023 to the end November. An increase of 77.8% is also recorded in the permits issued to citizens from Great Britain, from 208 to 370 at the end of November, numbers that are predicted to increase sharply when the processing of the thousands of pending applications by the ministry’s services is completed.