They were originally designed for Caribbean countries and became popular worldwide as an easy, perhaps the easiest, way to attract a country investments and hot foreign capital. Their popularity spread so much that he conquered her EU. in the years of the global financial crisis and the subsequent Eurozone debt crisis, giving way to wintering and often over-indebted economies. The reason for policies and measures such as “golden visa” and the tax breaks offered by its member countries Eurozone to third-party citizens who bought expensively real estate and with their funds they financially supported countries that needed them. Among them, of course, is Greece. These policies were later expanded due to the pandemic and telecommuting to include special visas for so-called “digital nomads”, that is, those who were able to settle in the place of their choice and work from there, wherever the headquarters of their work. These controversial policies brought billions to the countries that enlisted them in difficult times, sometimes directly into state coffers. In many cases, however, they created more problems than they solved, and some countries are already beginning to abolish them.

The “golden visa” policies and tax breaks for foreigners have been criticized as opening the door to “black” money and facilitating fraud, as well as financially supporting those who already have disproportionate wealth, often of dubious origin. Perhaps none of those who criticized them on these kinds of ethical criteria foresaw the side effects of these policies that sent real estate prices into the stratosphere causing a housing crisis. They mediated reactions within the countries by citizens who were effectively ostracized from their cities, as they are unable to find affordable housing. Thus, they finally pushed the governments to review their choices and withdraw the controversial policies.

Portugal and Ireland have already suspended their visa program for foreign real estate investors.

During the week Portugal announced that it was ending the policy of tax breaks for foreigners who bought real estate in the country, and Prime Minister Antonio Costa denounced this policy as an unjustified fiscal injustice. A few months earlier, in February, the government of Antonio Costa had already announced that it was ending the policy of the “golden visa” granted to citizens of third countries and with which it had managed to attract investments amounting to 6.8 billion euros to the country since 2012 , so it was adopted. Of course, the decision also involves visas for “digital nomads”. It had been preceded only a week earlier by a corresponding decision by Ireland, although the “golden visa” had brought a bundle of money to the country, as since the implementation of the measure 11 years ago it had attracted investments amounting to 1.25 billion euros.

Ireland had even suspended the program from March 2022 for Russian citizens, as part of sanctions against Moscow over the Russian invasion of Ukraine. Spain seems to be moving in the same direction, although it still maintains the controversial program. The opposition has been putting persistent pressure on the government, arguing that the country is “turning into a colony and harboring dirty money.”

A storm of restrictions for Airbnb

Airbnb’s platform has enabled any home owner to rent out their home for short periods of time, indirectly turning it into a profitable business. Offering a kind of get-rich-quick, Airbnb quickly became wildly popular, but just as quickly caused major problems in housing markets. It has been accused of being responsible for a wave of mass evictions by landlords eyeing the high incomes of short-term rentals, of driving rents into the stratosphere forcing residents of European tourist metropolises to leave, in short of causing a housing crisis, while breeding and fueling to the utmost excessive tourism, with all the ills it brings with it. It came to provoke demonstrations in historic cities in Italy and Spain, and it did not take long to force governments to impose control mechanisms.

From Europe to the US, from Amsterdam to Barcelona, Lisbon, Berlin and Florence, municipalities and governments are imposing restrictions on short-term rentals.

From Amsterdam to Barcelona and Florence, municipal authorities and governments are taking action on short-term rentals.

In Vienna from next July home owners will only be able to rent them out for 90 days a year when it comes to short-term rentals. In order to ensure that housing can also be made available for more permanent rental, the Austrian capital had imposed this restriction since 2018 in its tourist center, but is now extending it to the entire city.

In Paris, the authorities have imposed on property owners a corresponding restriction of up to 120 days a year, while when owners seek to extend the period of time they will rent their property to tourists or do the same with a second residence, then they are obliged to they list it as a type of furnished rental business. Italy, with its large number of cities of exceptional historical, cultural and touristic interest, is preparing to introduce fairly strict restrictions throughout its territory. Florence has already banned Airbnb rentals beyond its historic center, while tourist-heavy Venice and business-friendly Milan are moving in the same direction.

Unsurprisingly, Berlin has taken the toughest stance on Airbnb so far, as Germany’s historic capital faced a housing crisis before such platforms emerged. It had initially banned Airbnb from operating, but later lifted the ban and imposed strict restrictions, including heavy fines.

Prices are falling, manufacturers are going bankrupt

Both the policies deployed by governments to attract investment and the choices of property owners who often turned their primary residence into a business drove prices and rents sky high. All this until the beginning of the year, when everything suddenly changed. Inflation intervened, pushing central banks to aggressively raise interest rates while making the cost of living unaffordable.

House values across most of Europe remain around 50% higher than in 2014.

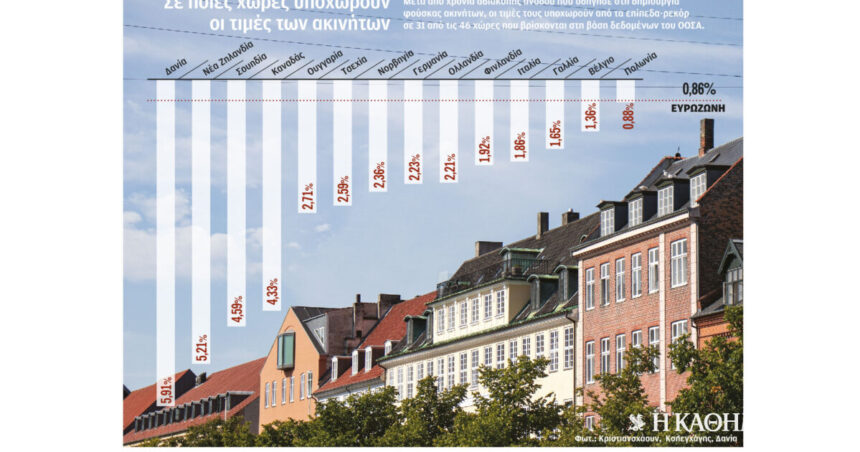

Mortgages became very expensive, as did everyday life, while construction costs for contractors and builders also rose sharply. Primarily, however, a large proportion of European would-be borrowers and property buyers have put off, for now at least, the dream of owning a home, and demand has fallen sharply. The result was a sharp correction in housing markets, in short a sudden drop in house prices. House prices in most of Europe remain at levels around 50% higher than in 2014, but have fallen in 15 of the 27 EU member states. The biggest drop in 12 months was recorded by prices in Sweden, recording a 15% drop, while in the first quarter of the year, prices in Denmark and Germany also recorded a large drop, falling by 6.5% and 5% respectively. Among the exceptions is touristic Croatia, which probably due to a phase difference from many EU member countries. it is still in high demand from foreign would-be buyers. Many of them flocked to it late last year in anticipation of its joining the Eurozone in January. Thus, prices in Croatia rose by 4.7%.

The inevitable consequence was the collapse of many small and large construction companies, which, faced with the increased cost of construction and the drop in real estate prices, declared bankruptcy. Perhaps the most famous case of a construction company that went bankrupt was that of the Gersh group in Germany. The group in question declared bankruptcy weeks ago, while it has 4 billion euros worth of projects under construction. The construction company Euroboden in Munich seems to be following in its footsteps, while the collapse of the Project Immobilien group preceded it in August. In Sweden, more than 1,000 Swedish construction firms have filed for bankruptcy in the first eight months of the year, and in Finland the number of new buildings is expected to fall this year to the lowest levels recorded since the 1940s.

Injustice

Defending the decision taken by the Portuguese government to abolish tax breaks offered to foreign property buyers, Portuguese Prime Minister Antonio Costa stressed that “if we were to maintain this measure we would be prolonging an unjustified fiscal injustice, which would continue to inflate and distort the housing market ».

6.8 billion euros it was the value of investment that Portugal’s tax breaks attracted to foreign property buyers.

Criticisms

Strongly criticizing the “golden visa” policy as well as any corresponding measure, including tax breaks for foreign buyers of expensive real estate, the European Parliament’s Committee on Civil Liberties emphasized in a statement that such schemes “are reprehensible and rejected from a moral, legal and from an economic point of view”.

1.5 billion euros the total income that was not taxed in Portugal is calculated

in the framework of tax exemptions for foreign real estate buyers.

The comment

Naomi Hirst, executive of the international anti-corruption organization Global Witness, recently commented on schemes such as the “golden visa” and tax breaks for foreigners, stressing that “when you have a lot of money that you have accumulated through dubious methods, to secure a new homeland away from the place from which he has stolen them is particularly attractive.’